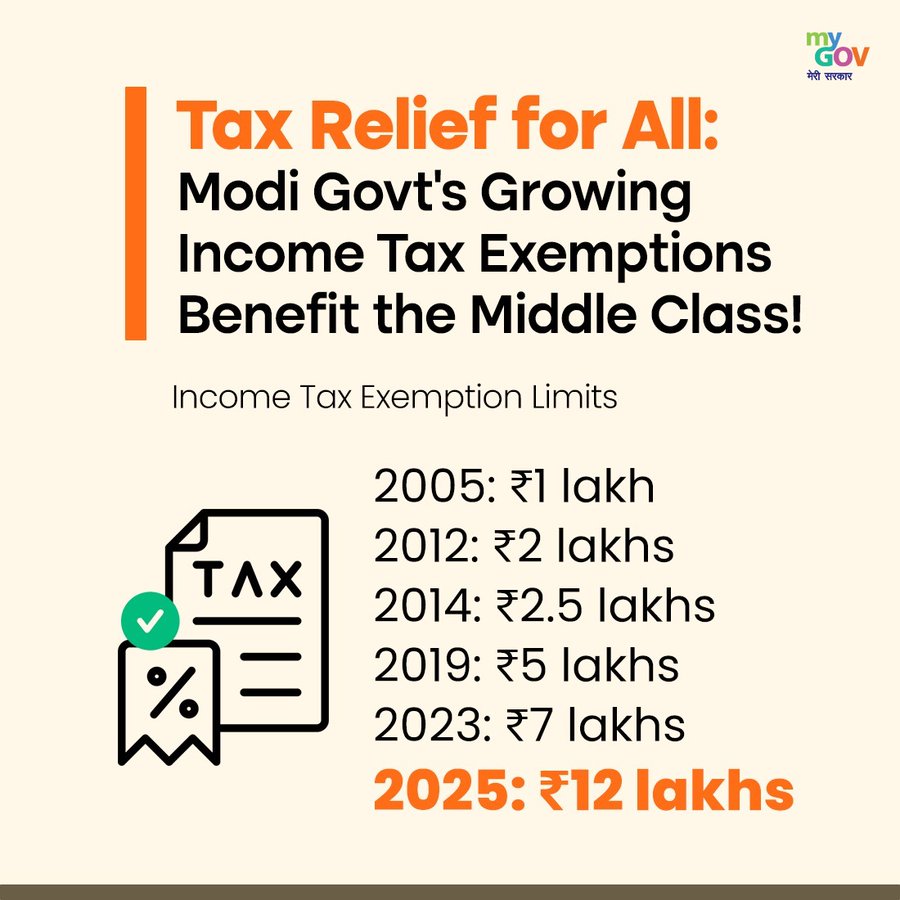

The Indian middle class demanded that Modi 3.0 deliver breathing space for them. They wanted a tax structure that reduces their burden and increases disposable income. The Income Tax Budget 2025 has answered this call by increasing the rebate limit under Section 87A from ₹7 lakh to ₹12 lakh.

NO INCOME TAX payable on income up to ₹12 lakh under the new regime!!

Big relief for Middle class 🔥#Budget2025 pic.twitter.com/2fSskT2hS5

— BALA (@erbmjha) February 1, 2025

This marks a significant step toward making the new tax regime more attractive, offering greater relief to salaried individuals and small taxpayers.

META MESSAGE FROM GOVERNMENT: CONSIDER THE NUMBER:

80% of Indians earn UNDER RS 12 LAKH PER ANNUM.

Tax exemption for this class of individuals is a massive relief.

Maa Lakshmi has blessed the Middle Class!— Rahul Shivshankar (@RShivshankar) February 1, 2025

Earlier, taxpayers earning up to ₹7 lakh received a full rebate, meaning they paid no tax. However, those earning even slightly above ₹7 lakh were taxed at standard rates. This ‘tax cliff’ often penalized those with incomes just above the exemption limit. Now, with the rebate limit extended to ₹12 lakh, many middle-class taxpayers will catch a much needed breath!

Income up to ₹12.75 lakh (after standard deductions) is effectively tax-free.

This adjustment is a game-changer for salaried employees, especially those in urban centers where living costs have skyrocketed. The increased rebate allows more take-home income, empowering individuals to spend, invest, or save according to their financial goals.

Income Tax Budget 2025 – Comparing the New and Old Tax Regimes

The revamped tax regime introduces more favorable slabs compared to previous years, offering a structured and simplified taxation system:

Breaking down the benefits of the new tax slab. pic.twitter.com/dJqvEzEvhQ

— Tushar Gupta (@Tushar15_) February 1, 2025

Under the old system, income beyond ₹7 lakh was taxed at progressively higher rates. The new system raises the tax-free threshold. Moreover, it also lowers the tax rate for incomes between ₹8 lakh and ₹16 lakh, ensuring a much lighter tax burden.

Additionally, under the older regime, an individual earning ₹10 lakh would pay ₹75,000 in taxes. Now, with the revised structure, the tax liability drops to ₹40,000. Thereby, delivering a savings of ₹35,000 from the get-go! This substantial reduction in taxes allows more financial flexibility for middle-income earners.

Beyond Income Tax: Additional Benefits for Renters and Senior Citizens

+ 'The limit for tax deduction on interest for senior citizens is being doubled from the present Rs 50,000 to Rs 1,00,000'

+ 'Annual limit fof 2.40 lakhs for TDS on rent is being increased to 6 lakhs'

Finance Minister Nirmala Sitharaman annunces pic.twitter.com/HC6DMXj8Px

— WION (@WIONews) February 1, 2025

The budget also introduces major tax reliefs beyond income tax rates.

- Higher TDS Limit on Rent: The TDS threshold for rental payments has increased from ₹2.4 lakh to ₹6 lakh annually. Consequently, benefitting individuals who rent homes as they will have fewer tax deductions on their rental payments.

- Higher Interest Deduction for Senior Citizens: The exemption limit for interest earned on bank deposits has doubled from ₹50,000 to ₹1 lakh. Thus, ensuring that retirees have better financial security.

- National Savings Scheme (NSS) Exemptions: Withdrawals from old NSS accounts are now tax-free, providing additional relief for senior citizens holding these accounts.

- These measures enhance the financial well-being of both salaried individuals and senior citizens, making tax compliance easier and savings more efficient.

Final Verdict: Is This Truly a Middle-Class Budget?

New Income-tax Bill Coming Soon!

A simpler, concise law—covering nearly half of the current tax rules.#ViksitBharatBudget2025#IncomeTaxBill#IncomeTax pic.twitter.com/8M8ylpSQO6

— MyGovIndia (@mygovindia) February 1, 2025

The Income Tax Budget 2025 presents one of the most significant tax reforms for middle-income earners in recent years. It increases the rebate limit to ₹12 lakh and reducing tax rates across key income brackets. Thus, the government provides a clear advantage to the salaried class.

Exact breakdown of Taxes in the new regime if you earn above 12L.#BudgetSession pic.twitter.com/scOk9QsyUz

— The Jaipur Dialogues (@JaipurDialogues) February 1, 2025

Pros of Income Tax 2025 for Middle Class:

- Higher rebate ensures individuals earning up to ₹12.75 lakh pay no tax.

- Lower tax rates for middle-income earners compared to the old regime.

- Increased take-home income leads to better savings and investment potential.

- Simplified tax structure makes compliance easier.

- Relief for renters and senior citizens ensures holistic financial benefits.

Cons of Income Tax 2025 for Middle Class:

- Individuals earning above ₹12 lakh still face a gradual tax hike.

- No additional deductions for common expenses like home loans and medical expenses under the new regime.

No income tax up to ₹12 lakh per annum for non-salaried and ₹12.75 lakh for the salaried. Higher income groups will also save up to ₹1 lakh.

One of the biggest reforms the middle class has seen in recent times. Thank you, @nsitharaman—well done!

Credit to the govt for…

— THE SKIN DOCTOR (@theskindoctor13) February 1, 2025

Overall, the 2025 budget signals a positive shift toward a more taxpayer-friendly system. The middle class finally gets some breathing room, with reduced tax liabilities and increased financial flexibility. For once, Nirmala Sitharaman and her team may have delivered a people-friendly budget!