US President Donald Trump’s Tariff War has backed China into a corner with a staggering 125% import tax on Chinese goods. Meanwhile, Trump’s tariff wars give all other nations 90 days of breathing space, with only 10% tariffs compared to the earlier released percentages.

The US is witnessing protests against the Trump administration for supporting Israel and the tariffs! However, far from being a mere protectionist measure, this act seems like a long-term geopolitical and economic chess game. Trump’s tariff war is not just about jobs or manufacturing. Instead, it is about power, leverage, and the reshaping of the global order.

While the world jitters with every presidential executive order, this move traps China in a silent economic war. The big question: is the U.S. setting the stage for a global recession to weaken its rivals, or is this a reset to secure long-term American dominance in the post-COVID world?

Will Trump’s Tariff War Crack the Tofu Dragon?

Analysts state that China’s economy has many structural vulnerabilities beneath the surface. Its growth model is based heavily on exports, infrastructure, and property. However, with Tofu building scams, its mask was torn off and the economy is beginning to stall.

The recent Trump tariff hikes directly target China’s biggest economic engines: tech and electric vehicles.

According to Goldman Sachs, China’s GDP growth is projected to slow to 4.5% in 2025, its lowest since the pandemic. This slowdown coincides with a collapsing real estate market (led by Evergrande and Country Garden), youth unemployment nearing 20%, and rising household debt. Add to this the slowing birth rate, and Beijing is in trouble. CCP’s attempts to stimulate the economy through credit expansion have failed to generate real consumption.

The tariff war isn’t just financial – it strikes at the CCP’s core legitimacy: delivering growth and jobs.

They shall render Chinese exports to the US uncompetitive. Additionally, alternative markets are drying up due to global de-risking strategies. Thus, Xi Jinping faces a tightening noose around the Dragon’s Neck.

Ripple Effects: Recession or Reset for the World?

The tariff war isn’t a bilateral issue anymore. It’s global. If the recent tariff hikes take place, they could trigger a full-scale global economic reset. JP Morgan estimates the likelihood of a global recession at 60% if tensions persist or escalate. The World Bank warns that disruptions to trade flows and investment confidence could strip off $1.2 trillion from global GDP by 2026.

Manufacturing nations in Southeast Asia – Vietnam, Malaysia, and India – have seen exports surge due to China’s declining influence.

However, this is a fragile gain. If consumer demand in the USA drops due to inflation caused by Trump’s tariffs, these new beneficiaries will suffer too. The EU is caught between a China-USA decoupling. The struggling Leftist economy of this nation might enter a prolonged inflation or recession.

Even commodities like rare earth metals and semiconductors, vital for green energy and tech, are at risk of facing severe bottlenecks.

Thus, this isn’t just a US trade war – it’s the beginning of a new Cold War, played out on economic spreadsheets rather than battlefields.

India: Strategic Opportunity or Dangerous Game?

India stands poised as a natural alternative to China. However, this position itself is a balancing act. With its massive domestic market, competitive labor costs, and favorable geopolitical outlook, India is an obvious candidate to attract USA and EU supply chains. PM Modi’s recent visit to the USA presented the ‘Mission 500’ – a promise to double total bilateral trade to $500 billion by 2030.

However, despite this promise, Trump’s tariff wars did not spare India – Bharat got slapped with a 25% tariff on steel, aluminum, and auto components.

Thankfully, Bharat got a 90-day reprieve from this tariff like the rest of the world excluding China. Trade between India and the USA stood at $128.8 billion in 2023; with exports growing in electronics, pharmaceuticals, and machinery. The government’s PLI schemes are already paying dividends in the electronics and semiconductor sectors.

Apple has started producing iPhones in India and is speculating shifting its base to Bharat in the face of China’s reluctance to bow to Trump.

Many Taiwanese suppliers are also setting up bases in Bharat to gain a competitive advantage in the market. But there’s a flip side. India’s trade deficit with China has ballooned to over $100 billion. There is a dependency on Chinese raw materials and components for Indian exports. In a global slowdown, this imbalance can worsen. A wounded China possibly resorting to nationalism, cyber warfare, or border skirmishes to distract its people from the changing world dynamics.

Thus, India must also brace for strategic pushback from its northern neighbor.

Yet, in the long game, India is set to benefit. If it strengthens infrastructure, as implied by the Minister Piyush Goyal. And if it simplifies regulations, as demanded by many Startups. And finally, if it ramps up energy security that could position Bharat as the centerpiece of the new de-globalized manufacturing map.

Debt, Diplomacy, and Dollar Warfare

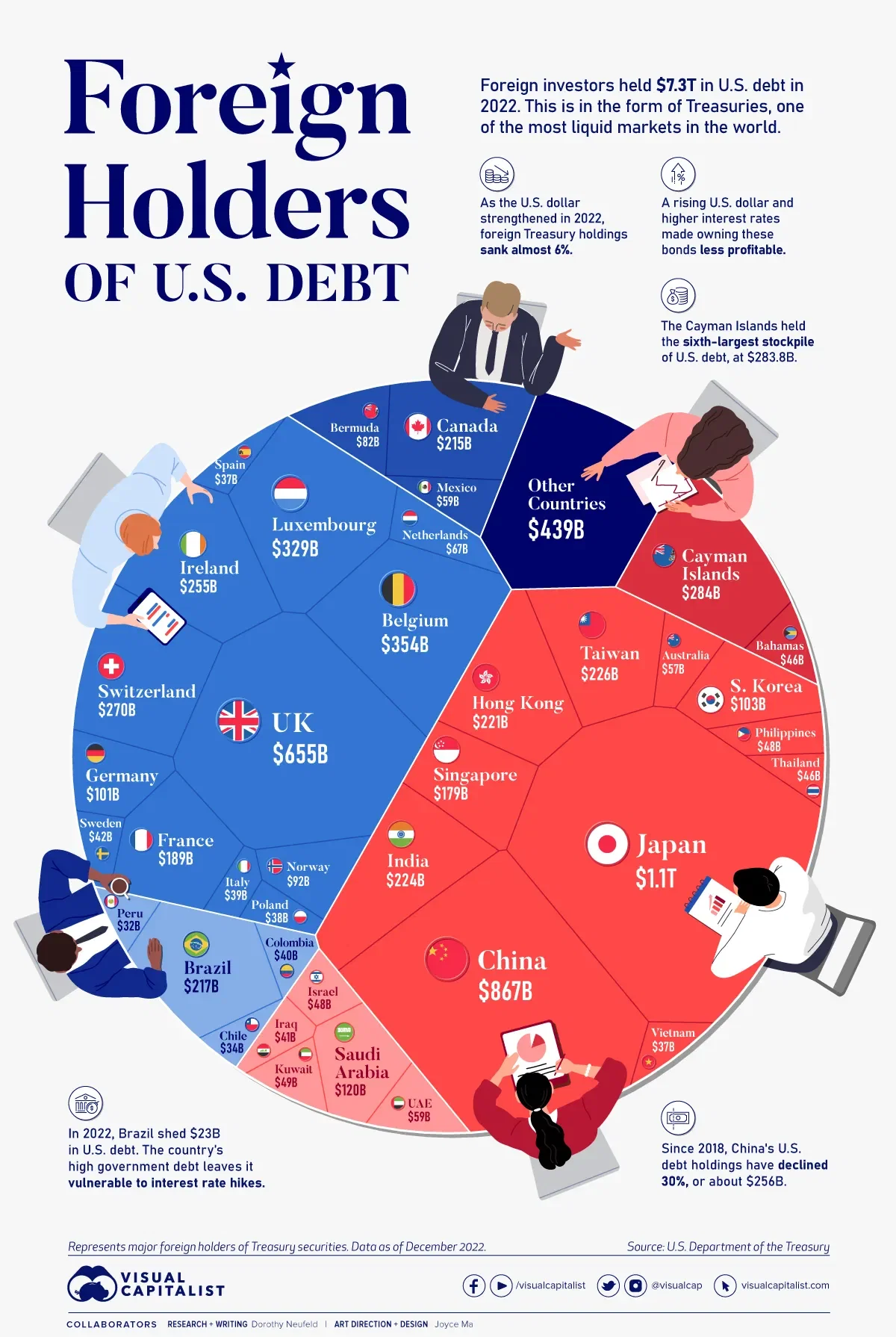

At the heart of the US strategy of the tariff war is a rarely acknowledged factor: its $34 trillion national debt. China and Japan are the largest holders of US Treasury securities. As of early 2024, Japan holds $1.1 trillion, while China has trimmed its holdings to around $759 billion—its lowest since 2009. However, this reduction isn’t accidental.

China has been slowly de-dollarizing, investing in gold, BRI trade deals in yuan, and increasing its currency swaps with countries like Russia and Iran.

Japan, on the other hand, reportedly warned of shedding U.S. bonds in case of deteriorating trade terms. Trump’s tariff exemptions for Japan – while targeting China – reveal this delicate balance.

By pushing tariffs on China while exempting allies, the US is trying to isolate the CCP and choke the PRC’s economy! Hence, by forcing Beijing into a corner Trump aims to shake global markets and stop the collapse of the dollar. But this is dangerous. If China and other creditors stop buying US debt altogether, Washington will face a dollar crisis. That might lead to a downward debt spiral for the USA.

Tariff War – A Coming Collapse or A Controlled Transition?

Tariff War isn’t about trade. It is about collapsing the CCP’s power base and forcing a global reset. China overshadows the USA in terms of production and influence. Thus, these tariff wars are just the visible weapons – technology bans, investment blacklists, financial sanctions, and military alliances are the real arsenal.

China retaliated with a retaliatory tariff of its own. But the real war may be cyber sabotage or a currency crisis aimed at toppling the dollar’s dominance. The CCP needs to maintain face and control. But, if its economy collapses, nationalism may become the only glue to hold the country together.

Therefore, India and Taiwan – its two main competitors and hostile nations must prepare for turbulent years ahead.

But if Trump manages to decouple the USA and reset its economy without triggering hyperinflation or bond selloffs, a new global economic order could emerge. This order would put America back at the center of the world with India as a key pillar. And China may once again be isolated behind another Iron Curtain. No matter what, the world economy will be reshaped soon. However, not by diplomacy or development – but by deliberate disruption.

2029 is the target for reset. World be ready.